Healthcare for Everyone

Seniors enjoy no provider fees, 24/7 doctor access free, Free annual checkups.

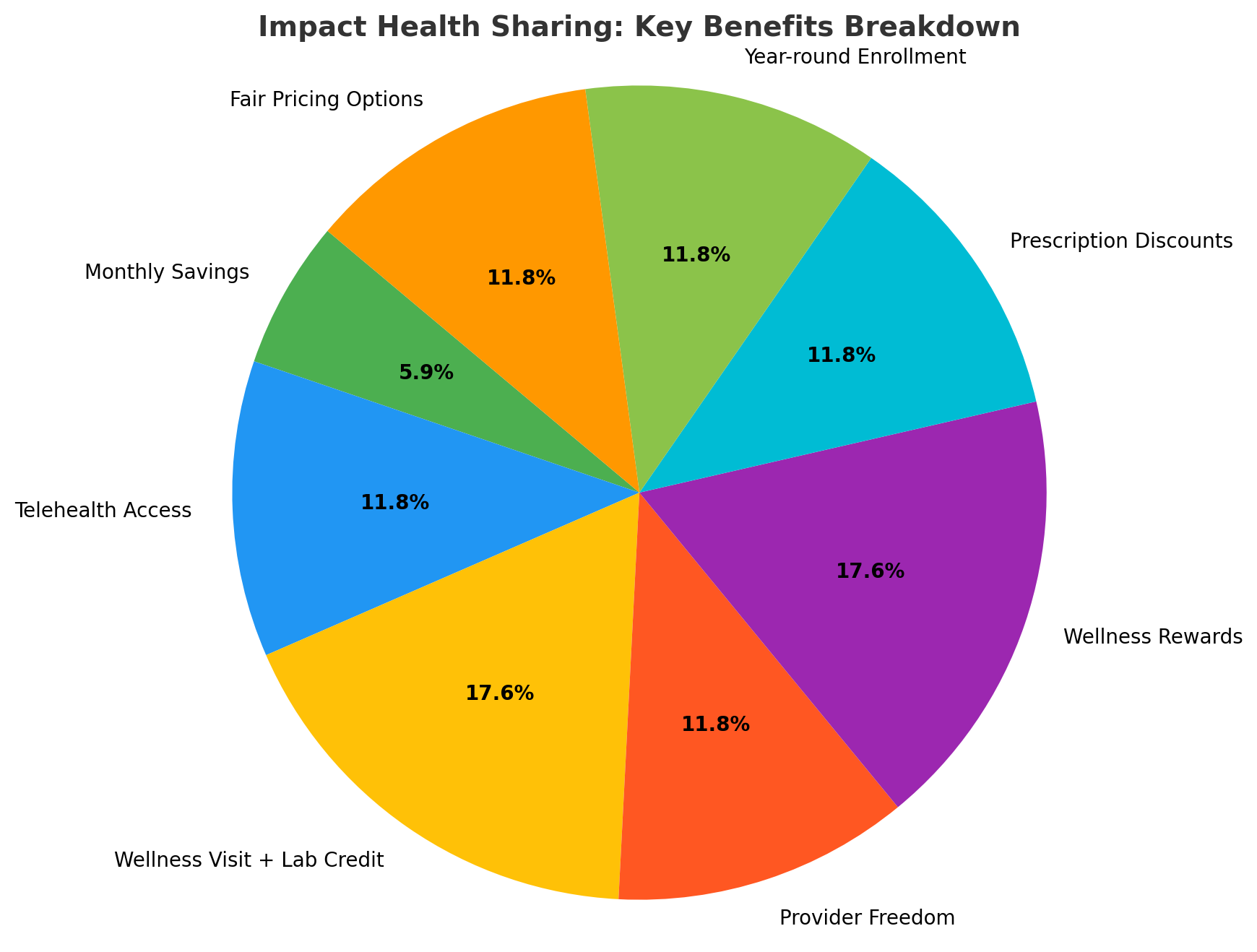

Telehealth with $0 fees, Free annual checkups, and up to $150/month in wellness rewards.

$0 virtual doctor visits, 1 free annual checkup, and up to $150/month in wellness rewards.

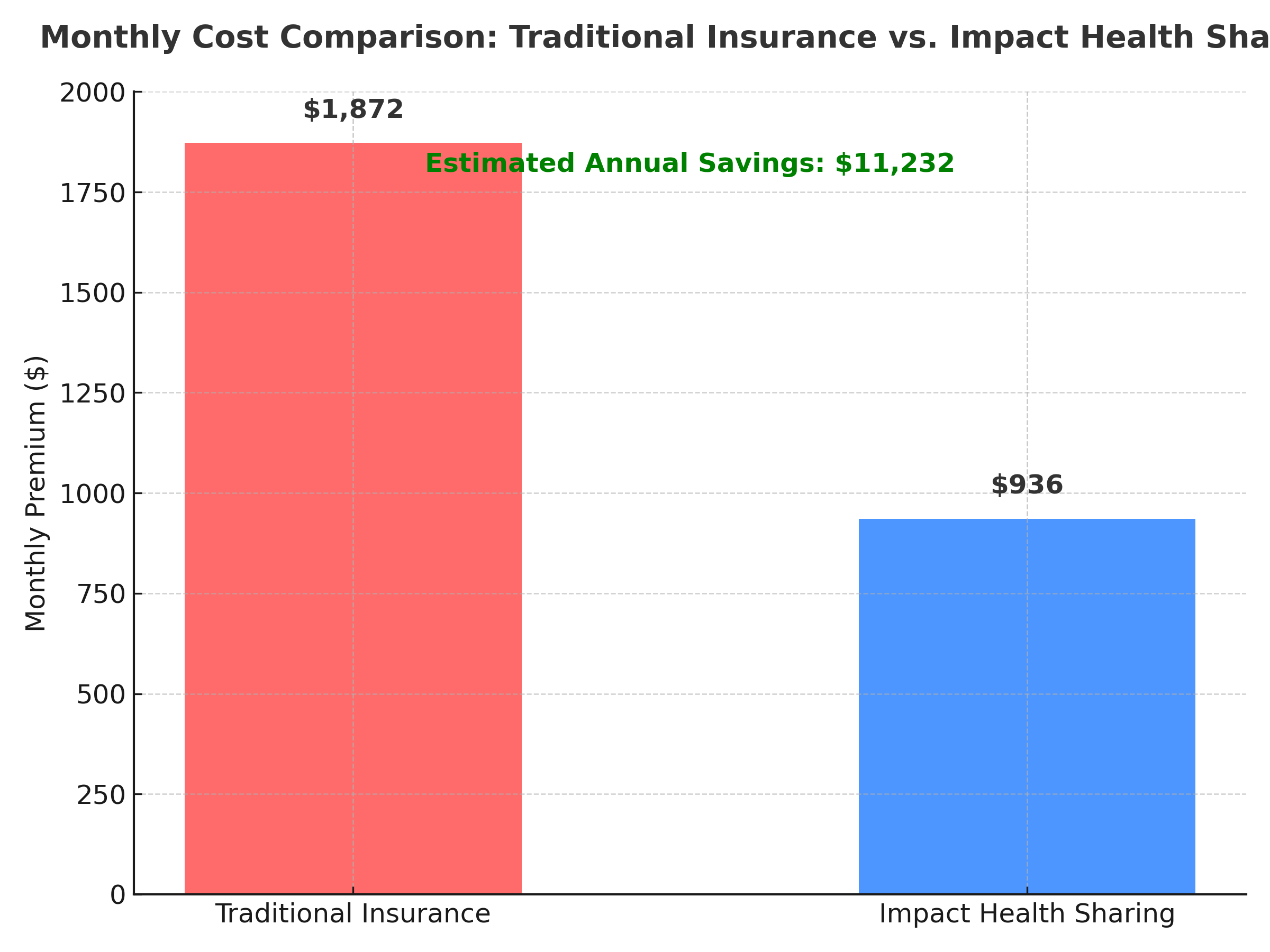

$378/month covers the whole family—plus rewards, discounts, and total flexibility.